All Categories

Featured

Table of Contents

- – Can I use Policy Loan Strategy to fund large p...

- – Can I use Wealth Building With Infinite Bankin...

- – What resources do I need to succeed with Infi...

- – What are the risks of using Private Banking S...

- – Infinite Banking Cash Flow

- – What financial goals can I achieve with Weal...

- – What is Infinite Banking Concept?

Term life is the excellent solution to a short-lived demand for securing against the loss of an income producer. There are far fewer reasons for long-term life insurance. Key-man insurance policy and as part of a buy-sell agreement come to mind as a possible good factor to buy a permanent life insurance policy plan.

It is an expensive term coined to market high priced life insurance with ample compensations to the representative and substantial profits to the insurance provider. Generational wealth with Infinite Banking. You can reach the exact same result as boundless financial with far better outcomes, more liquidity, no risk of a plan gap activating a massive tax issue and even more choices if you use my alternatives

Can I use Policy Loan Strategy to fund large purchases?

Compare that to the predispositions the marketers of infinity financial receive. 5 Blunders Individuals Make With Infinite Banking.

As you approach your golden years, monetary protection is a leading priority. Among the numerous different financial methods out there, you might be hearing increasingly more concerning infinite financial. Infinite Banking cash flow. This concept enables practically any individual to become their very own bankers, using some benefits and flexibility that can fit well into your retirement

Can I use Wealth Building With Infinite Banking to fund large purchases?

The finance will accrue straightforward interest, yet you keep flexibility in setting payment terms. The rate of interest price is additionally traditionally less than what you would certainly pay a conventional bank. This sort of withdrawal permits you to access a portion of your cash money worth (as much as the amount you have actually paid in premiums) tax-free.

Many pre-retirees have problems regarding the safety and security of unlimited banking, and completely factor. While it is a legit strategy that's been adopted by individuals and companies for years, there are threats and disadvantages to take into consideration. Unlimited financial is not a guaranteed means to build up wealth. The returns on the cash money value of the insurance plan might change depending upon what the marketplace is doing.

What resources do I need to succeed with Infinite Banking Account Setup?

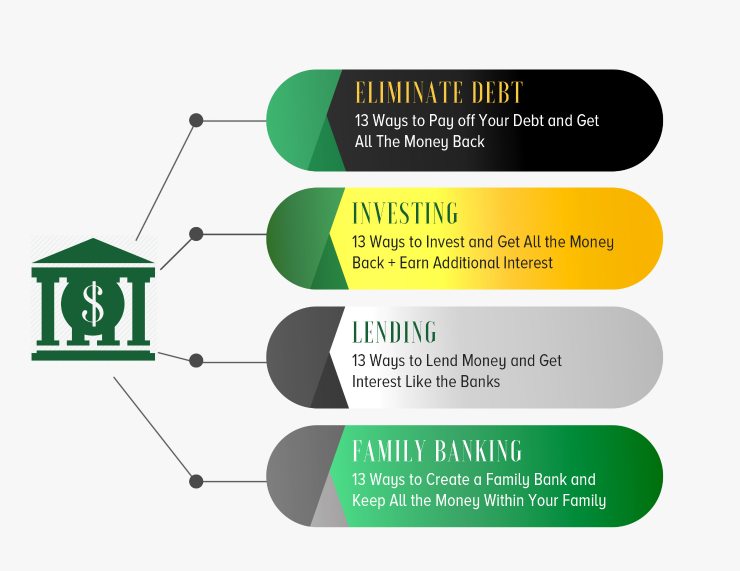

Infinite Financial is a financial method that has gotten significant attention over the previous couple of years. It's a distinct method to managing individual finances, allowing people to take control of their money and produce a self-sustaining financial system - Borrowing against cash value. Infinite Banking, additionally referred to as the Infinite Banking Concept (IBC) or the Bank on Yourself approach, is an economic strategy that includes utilizing dividend-paying whole life insurance policies to produce an individual banking system

To understand the Infinite Financial. Principle approach, it is as a result vital to offer a summary on life insurance policy as it is a very misconstrued asset class. Life insurance coverage is an essential part of economic planning that provides lots of benefits. It comes in numerous forms and sizes, the most typical types being term life, whole life, and universal life insurance.

What are the risks of using Private Banking Strategies?

Term life insurance, as its name suggests, covers a certain period or term, generally between 10 to 30 years. It is the easiest and commonly the most budget friendly kind of life insurance coverage.

Some term life plans can be restored or converted right into an irreversible plan at the end of the term, yet the premiums usually enhance upon renewal because of age. Whole life insurance policy is a kind of permanent life insurance policy that provides protection for the insurance holder's whole life. Unlike term life insurance policy, it consists of a cash worth part that grows gradually on a tax-deferred basis.

However, it is necessary to bear in mind that any kind of superior loans taken versus the policy will certainly lower the fatality benefit. Entire life insurance policy is usually much more costly than term insurance policy due to the fact that it lasts a life time and constructs cash worth. It likewise supplies foreseeable costs, indicating the cost will not boost in time, offering a degree of assurance for insurance holders.

Infinite Banking Cash Flow

Some reasons for the misconceptions are: Complexity: Entire life insurance policy policies have extra elaborate features compared to label life insurance policy, such as cash worth accumulation, dividends, and policy fundings. These attributes can be testing to comprehend for those without a background in insurance or individual money, causing confusion and misunderstandings.

Bias and false information: Some individuals may have had unfavorable experiences with whole life insurance policy or heard tales from others that have. These experiences and unscientific details can add to a biased sight of whole life insurance policy and perpetuate misunderstandings. The Infinite Financial Idea strategy can just be applied and implemented with a dividend-paying whole life insurance policy policy with a mutual insurer.

Entire life insurance policy is a sort of irreversible life insurance policy that provides coverage for the insured's whole life as long as the costs are paid. Whole life policies have 2 main parts: a survivor benefit and a cash value (Financial leverage with Infinite Banking). The death advantage is the quantity paid to beneficiaries upon the insured's death, while the cash money worth is a cost savings component that grows gradually

What financial goals can I achieve with Wealth Management With Infinite Banking?

Reward repayments: Mutual insurance provider are possessed by their insurance holders, and consequently, they might disperse earnings to insurance policy holders in the form of returns. While rewards are not assured, they can help boost the money worth growth of your policy, raising the general return on your capital. Tax advantages: The cash money worth development within an entire life insurance policy policy is tax-deferred, implying you don't pay tax obligations on the development until you take out the funds.

This can give substantial tax benefits compared to various other savings and investments. Liquidity: The cash money value of a whole life insurance plan is highly liquid, allowing you to access funds easily when required. This can be specifically valuable in emergency situations or unexpected monetary situations. Asset protection: In many states, the cash money value of a life insurance coverage plan is shielded from creditors and lawsuits.

What is Infinite Banking Concept?

The policy will certainly have instant money value that can be placed as security one month after funding the life insurance policy for a revolving line of credit history. You will have the ability to accessibility with the revolving credit line as much as 95% of the readily available cash money worth and use the liquidity to money an investment that supplies income (money flow), tax benefits, the chance for appreciation and utilize of other individuals's capability, capabilities, networks, and capital.

Infinite Financial has ended up being popular in the insurance world - a lot more so over the last 5 years. Lots of insurance agents, throughout social media sites, insurance claim to do IBC. Did you understand there is an? R. Nelson Nash was the maker of Infinite Financial and the organization he established, The Nelson Nash Institute, is the only company that officially licenses insurance coverage agents as "," based upon the adhering to requirements: They straighten with the NNI standards of professionalism and reliability and values.

They effectively finish an apprenticeship with a senior Accredited IBC Expert to guarantee their understanding and capacity to apply all of the above. StackedLife is Authorized IBC in the San Francisco Bay Location and works nation-wide, helping customers understand and carry out The IBC.

Table of Contents

- – Can I use Policy Loan Strategy to fund large p...

- – Can I use Wealth Building With Infinite Bankin...

- – What resources do I need to succeed with Infi...

- – What are the risks of using Private Banking S...

- – Infinite Banking Cash Flow

- – What financial goals can I achieve with Weal...

- – What is Infinite Banking Concept?

Latest Posts

Be Your Own Bank

Be My Own Bank

Paradigm Life Infinite Banking

More

Latest Posts

Be Your Own Bank

Be My Own Bank

Paradigm Life Infinite Banking