All Categories

Featured

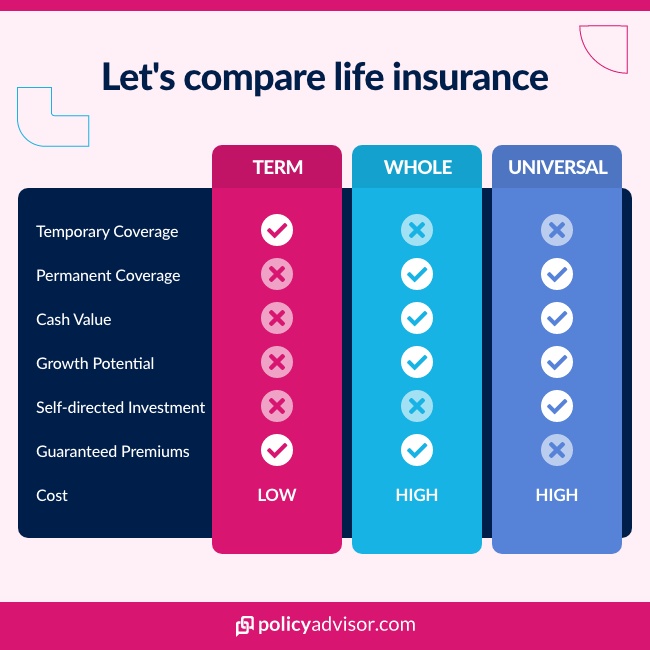

Whole life insurance coverage plans are non-correlated possessions - Infinite wealth strategy. This is why they work so well as the financial structure of Infinite Financial. Regardless of what occurs in the market (supply, property, or otherwise), your insurance coverage keeps its well worth. Also lots of people are missing out on this vital volatility buffer that assists protect and grow riches, rather splitting their money right into two pails: bank accounts and investments.

Market-based financial investments grow riches much quicker but are revealed to market changes, making them naturally risky. What happens if there were a 3rd pail that used security but also modest, guaranteed returns? Whole life insurance policy is that third container. Despite just how diversified you think your portfolio may be, at the end of the day, a market-based financial investment is a market-based investment.

Latest Posts

Be Your Own Bank

Be My Own Bank

Paradigm Life Infinite Banking